The Rise of Location Data Marketplaces and the Plight of Subway Sandwiches

“I’ll take the No. 2 Subway sandwich.”

“Do you want that on wheat or Italian bread?”

“I think Italian.”

“Do you want lettuce with that?”

“Sure.”

“How about tomatoes?”

“Absolutely.”

“Would you like extra cheese?”

“Yes!”

“What kind?”

“Uh…what kind do you have?”

“Well. We have…cheddar, swiss…provolone…”

This is a typical conversation about a Subway sandwich. I’m sure you’ve had a similar exchange. There are sometimes more choices that can take you into an extended, maybe frustrating conversation. On the other hand, if you visited a McDonald’s, you’d just order a Big Mac which has the same ingredients all the time, at every McDonald’s, all around the world. No problem with choice here.

The point is, sometimes you want a customized order…not the ordinary, more commoditized item on the menu. But, if you go the route of customization, are you prepared for all the choices?

The Data Marketplace User Experience

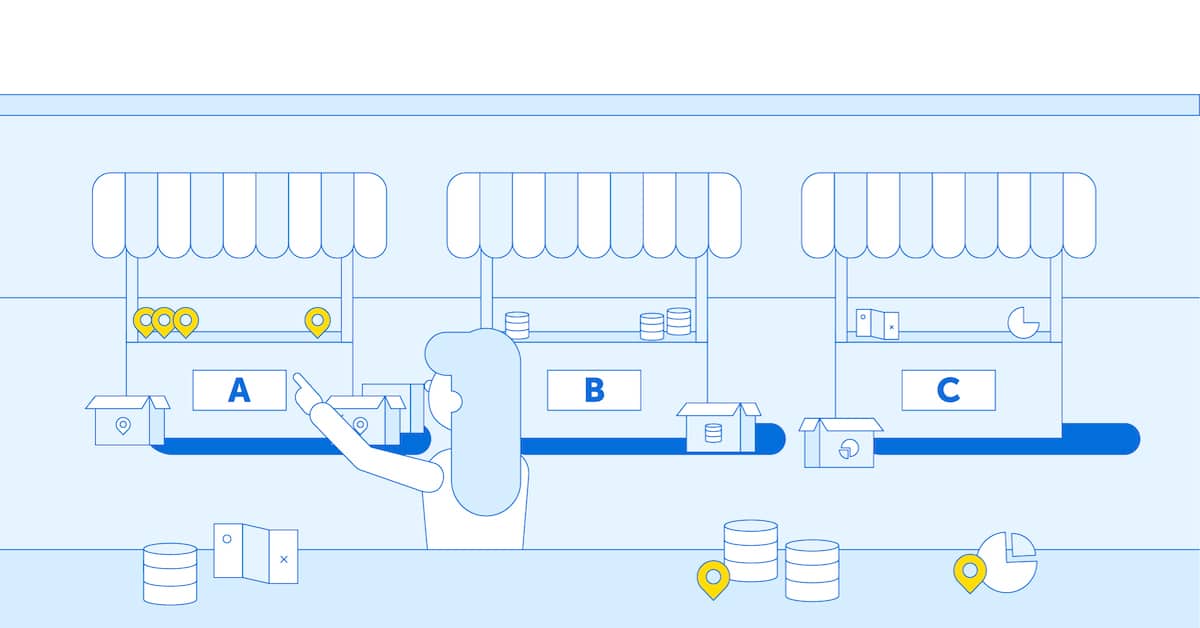

The example above is about food but let’s now imagine a similar conversation about geospatial data. When a typical geospatial professional or data analyst enters a virtual store, what should they expect and what should the vendor provide? With the rise of such data marketplaces and Data as a Service (DaaS), what are the user’s expectations?

Today, we are familiar with an abundance of geospatial data providers offering everything from demographic profiles, property and building information, points of interest, streets and speed limits, and even more basic data such as ZIP code boundaries or the location of every Walmart in North America. And, with the plethora of data in formats designed for the more popular geographic information systems, much of these data are ready to be used for most every geospatial project imaginable.

The typical geospatial professional, when faced with the need for data, would probably visit the ArcGIS Marketplace, CARTO Spatial Data Catalog, Precisely’s Data Experience or HERE’s Marketplace. In each, there are layers upon layers of data, and options at each level of geography. New geospatial users, or data analysts, those whose daily job is working with Tableau or Microsoft PowerBI, may be browsing elsewhere such as Amazon’s AWS Data Exchange or Snowflake’s Data Marketplace.

In the case of AWS or Snowflake, who are not market-specific to geospatial data, there is a limit to the availability of data. Likewise, the user needs to be somewhat more astute and know exactly what they are hoping to accomplish the data. These marketplaces typically offer choices by vendor but not necessarily by type of data or geographic extents. Searching for data will likely yield broad categories and not specific data types or products. Often, they will re-direct your web search to the specific vendor.

While some could argue that these marketplaces reinforce the “vendor-lock-in” effect, there’s an accelerating trend to provide more flexibility to let the user decide the format in which the data is being delivered, as well as also offering the possibility of using the data outside the vendor’s ecosystem.

The Hidden Complexity of a Subway Sandwich

Now let’s take an example closer to the geospatial domain.

You are on the hunt for demographic data to perform a site selection project for a new Dollar Tree store in Peoria, Illinois (it’s always Peoria, right?). Dollar Tree well understands the persona of the typical buyer: low to middle income, high school education, and spends an average of $7.35 per visit. To discern a trade area and average revenue per square foot, however, you need more data.

- Is the trade area based on ZIP codes or Census tracts?

- What’s the average travel time to each store? To answer that question you need residential streets, not just major highways.

- Psychographic profile information might be helpful as well. Do you want CAMEO or PRIZM?

- The store will be located inline versus outparcel, so you need available real estate and the rental rates of strip malls.

- Traffic counts are useful. Do you want data from HERE Technologies, TomTom, INRIX, Waze?

- Income data is particularly useful. Do you want data from the American Community Survey or will decennial Census data work as well?

- Parking lot details such as lighting and average number of cars is helpful too. Where do you get such data?

Even the most senior geospatial analyst would be hard-pressed to answer these questions. Now, let’s imagine a data analyst or someone new to GIS faced with this challenge. They don’t know what they don’t know and presenting them with a data marketplace buffet isn’t going to solve the problem. They come looking for the Big Mac but what they really want is something customizable.

The challenge is multiplied when users start to look at end user license agreements (EULAs). There are certain restrictions with data usage:

- Will they use it for an internal or a customer project?

- Will the data be shown on a publicly facing website?

- Will the data persist in a database?

- For how long do you want to license the data?

- How many times do you expect to use an API?

- How many users will be using it?

- Do you want fries with that?

Sorry, I digress. In short…it’s complicated.

Last but not least, pricing! This is perhaps one of the more perplexing areas for purchasing data. Some vendors are charging per user, per asset, per transaction, per server or per core, while some charge depending on the use case (i.e., value-based pricing). Geographers understand the world presents mostly physical barriers such as oceans and mountains. But you wouldn’t want to buy data for only the Rocky Mountains. Users want defined administrative boundaries like city limits or designated market area (DMA) boundaries. Yet even those levels of geography are too large which explains the need to understand the exact area of interest so that users can settle on a price and conform to the license specifications.

But what if you only need a very specific area? This is often referred to by vendors as a minimum bounding rectangle in which the user draws a box to “cookie-cut” only the area for which they are willing to pay. Imagine, given the questions asked above, how vendors will price these “customized” inquiries for data. The complexity goes far beyond ordering a Subway sandwich.

How to Buy Smart?

Certainly, buyers want options and alternatives. They want to speak with someone that can offer unique and valuable market perspective. They want to understand the pitfalls and avoid going down the rabbit hole. They want to do business with an organization from whom it is easy to buy. Ultimately, they want convenience.

Purchasing geospatial data is not easy and just offering it up in a data marketplace doesn’t make it more convenient; but there is a solution. As a value-added reseller of the premier geospatial data providers, Korem can help answer these questions, and work with you to make sure that data can be supplied to meet the use case for which your project will benefit. Because there’s a dearth of geospatial expertise, what many businesses fail to realize is even if their organization already has a plethora of geospatial data, they may not be using the right data to perform the right tasks. More problematic, different corporate departments may be purchasing exactly the same data, from different sources which they may not be legally entitled to use. The result is a violation of the EULA or non-compliance with other license specifications.

But there are options and Korem is here to help you buy smart!